Auto Insurance Rates Have Skyrocketed — And In Ways That Are ... Things To Know Before You Get This

cheap insurance insurance low-cost auto insurance cheaper car

cheap insurance insurance low-cost auto insurance cheaper car

Where You Live Can Increase Your Costs, Did you understand that city areas have differing degrees of higher insurance claims prices? Greater thickness equals a lot more dangers, more crashes and also more thefts. Utilizing 2011 stats, the ordinary insurance claims set you back per lorry in one city was 25% over that of a neighbouring city.

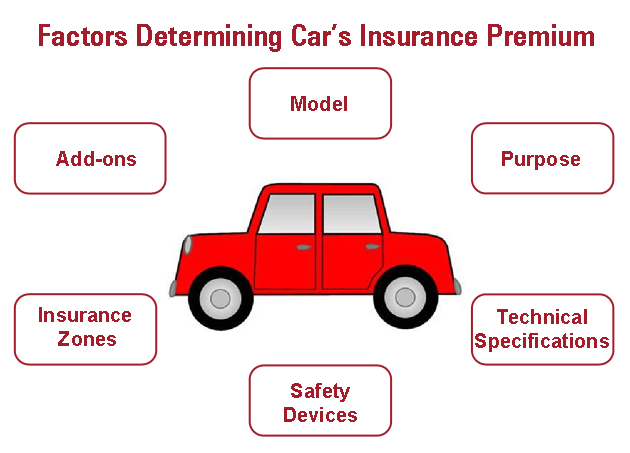

The amount you'll spend for car insurance is impacted by a variety of very different factorsfrom the sort of protection you have to your driving document to where you park your vehicle. While not all business make use of the very same specifications, here's a checklist of what typically determines the lower line on your automobile plan (auto insurance).

If you've had mishaps or significant web traffic infractions, it's most likely you'll pay even more than if you have a tidy driving document. You may likewise pay even more if you're a new chauffeur without an insurance performance history. The more miles you drive, the even more opportunity for accidents so you'll pay more if you drive your auto for work, or use it to commute fars away. cheaper car insurance.

Insurers generally Helpful resources bill more if young adults or young people listed below age 25 drive your auto. accident. Statistically, women have a tendency to enter less accidents, have less driver-under-the-influence accidents (Drunk drivings) andmost importantlyhave much less severe accidents than males. All other points being equal, females frequently pay much less for auto insurance than their male equivalents.

Comparable to your credit report, your credit-based insurance policy rating is a statistical tool that forecasts the chance of your filing an insurance claim and also the most likely expense of that case - insurance. The limits on your standard auto insurance policy, the quantity of your insurance deductible, and also the kinds and amounts of plan alternatives (such as collision) that are sensible for you to have all affect just how much you'll spend for coverage.

The Buzz on Auto Insurance Climbing 5% In 2022. Where It's Most, Least ...

Auto insurance policy covers the lorry owner against the economic loss(es) due to burglary or unexpected damage of the insured lorry together with the legal obligation that might occur because of 3rd celebration losses. The coverage is based on the conditions specified in the plan document. It is required to have motor insurance coverage if you own an auto and the policy satisfies your lawful responsibility that may develop as a result of physical loss/damage or damage triggered to a 3rd party.

The mode of payment will be once, at the time of acquiring the plan for the full plan duration. The vehicle insurance policy costs may differ in terms of price, depending upon the insurance policy carrier, the kind of car, geographical location, the sort of insurance policy cover you have chosen for, add-on protections, insurance coverage insurance deductible, as well as various other aspects, including your driving document and also even your age. credit score.

We rarely trouble to check out all the great print and also have a tendency to focus on the highlights such as premium quantity, insurance coverage term, fundamental protections provided by the plan, etc. As the costs quantity is the prime emphasize while purchasing the plan, we have a tendency to just contrast the numbers without actually comprehending exactly how the amount presented itself (vans).

When you buy a brand-new auto as well as acquire an insurance plan, the insurer decides the IDV based on the ex-showroom cost and the depreciation according to the India Motor Toll (IMT). Now, the value of your automobile begins diminishing every year as per the depreciation slab outlined in IMT.

It's advisable to select the proper IDV depending upon the age and also ex-showroom price of the automobile to ensure that the car will be insured with adequate insurance coverage. cheap car insurance. When you acquire a brand-new auto, its value will be higher than a four-year old cars and truck. The insured declared worth or IDV is the value that has actually been made a decision for your car to determine its worth at the time of the insurance claim & to calculate the premium accordingly.

The Main Principles Of How To Estimate Car Insurance Before Buying A Car - Usa Today

At the time of renewal, the price will be adjusted for any type of devaluation to the vehicle as well as the devices. Mean you are buying an insurance policy cover for a car that is over 5 years of ages. Because case, the IDV will certainly be figured out based on an understanding between you and also the insurance coverage service provider after adjusting the worth after depreciation.

Please keep in mind that the IDV computation uses just for the Own damages area of the insurance plan as well as out the legal third-party insurance coverage. Often the insurance provider prices quote a low premium by unnaturally minimizing the IDV and you require to be careful on this front. Age of the Vehicle As your car grows old, it starts losing worth as a result of different factors.

The primary reason for the worth devaluation is the general wear and tear of the vehicle contrasted to the new design. Insurer have a collection schedule that applies to vehicles and their market price depending upon the age. The routine is independent of the brand of the vehicle. laws. Typically, the routine looks like this: Engine's Cubic Capacity Every cars and truck's engine size is measured according to its cubic capacity.

The automobiles in these cities are assumed to be a lot more susceptible to crashes as well as burglary. The insurance costs for cars and trucks in Area A is higher than that in Area B. Third-Party Coverage In India, it is obligatory to have third-party insurance coverage if you have an automobile.

The quantity differs from person to person and additionally depends upon the mix of the factors discussed over (cheaper). The bottom line is selecting the appropriate automobile insurance coverage cover that uses an extensive cover and also makes certain extensive defense against economic losses.

The Best Car Insurance Calculator For Estimating Cost Fundamentals Explained

An insurance policy premium is the quantity of cash an individual or organization pays for an insurance policy. Insurance policy premiums are paid for plans that cover healthcare, car, house, and also life insurance policy.

Key Takeaways An insurance coverage premium is the quantity of cash a specific or organization need to spend for an insurance coverage plan. Insurance coverage premiums are paid for policies that cover health care, vehicle, home, as well as life insurance policy. Failing to pay the costs for the private or business may cause the cancellation of the policy and a loss of protection.

Life insurance policy In the situation of a life insurance policy plan, the age at which you begin coverage will determine your premium quantity, together with other threat elements (such as your present health and wellness). The younger you are, the lower your costs will typically be. On the other hand, the older you obtain, the much more you pay in premiums to your insurance coverage business. insure.

risks affordable car insurance insurance insure

risks affordable car insurance insurance insure

There is an active discussion between those who state formulas will change human actuaries in the future and those who compete the raising usage of algorithms will call for greater engagement of human actuaries as well as send the career to a "following degree." Insurance providers utilize the costs paid to them by their consumers and also insurance policy holders to cover obligations related to the policies they underwrite.

accident cheaper car insurance business insurance credit score

accident cheaper car insurance business insurance credit score

This can offset some expenses of giving insurance coverage and assist an insurance provider keep its prices competitive. While insurer might spend in assets with differing degrees of liquidity and returns, they are called for to preserve a particular degree of liquidity in all times. State insurance coverage regulatory authorities established the variety of fluid possessions required to make certain insurers can pay claims (money).

The 7-Minute Rule for How To Reduce Your Auto Insurance Premiums

The other choice is to attempt going with an insurance coverage representative or broker. Several brokers can attach you to life, automobile, house, and also health and wellness insurance policy policies.

Some insurers spend in the premium to produce greater returns. By doing so, the business can offset some prices of providing insurance coverage as well as help an insurance firm keep its costs affordable within the market. What Are the Secret Variables Influencing Insurance Coverage Premiums? Insurance policy premiums rely on a range of factors including the type of protection being acquired by the insurance policy holder, the age of the policyholder, where the policyholder lives, the case history of the policyholder, and also moral danger and adverse choice.

What Is an Auto Insurance Premium? Your auto insurance policy premium is how much you pay for your car's protection. cars. It's based on your driving document, automobile and the coverage you choose.

Driving Habits & Document Your current driving routines and your history of cases can impact your insurance costs. So, if you've had a great deal of insurance claims in the past, you'll likely pay more for insurance policy. If you have current tickets, your costs might be greater. Type of Vehicle You Drive The kind of automobile you drive can influence just how much you pay for insurance policy. car insured.

These quotes are not final and also may boost or reduce as you proceed undergoing the acquiring process. Obtain a Quote for Auto Insurance Today - cheap insurance.

Some Known Incorrect Statements About The Best Car Insurance Calculator For Estimating Cost

Your cars and truck insurance coverage costs is the quantity you pay your insurance coverage company for insurance coverage. Insurance companies establish your costs according to risk factors, like driving background, age, credit report, and extra. Since car insurance policy premiums depend upon a variety of factors, your prices will be different from what others pay.

Depending on your preference, you might pay a car insurance coverage costs on a regular monthly, semi-annually, or annual basis. If you fail to pay your vehicle insurance policy costs, you might encounter a lapse in coverage as well as have to pay more for insurance coverage in the future - accident.

Exactly how are automobile insurance costs computed? Insurance policy firms think about a selection of threat aspects when computing your cars and truck insurance coverage costs.

Your area: Automobile insurance policy premiums vary depending on your state, city, as well as even postal code. trucks. Areas with even more motorists, high rates of without insurance chauffeurs, and also high medical prices typically pay a lot more for insurance coverage. Your driving history: Motorists that have actually been associated with collisions, obtained tickets, or that are unskilled behind the wheel pay greater rates than their counterparts.

auto cars low-cost auto insurance perks

auto cars low-cost auto insurance perks

The ordinary automobile insurance premium drops if you can't manage to pay for your premiums all at as soon as or you simply desire much more flexibility when planning your costs and also you decide to pay your premiums greater than once per year. On the adhering to table, we have provided the typical six-month as well as month-to-month costs for different protection degrees.

The Main Principles Of Average Car Insurance Cost (May 2022) - Wallethub

cheaper credit score accident insure

cheaper credit score accident insure

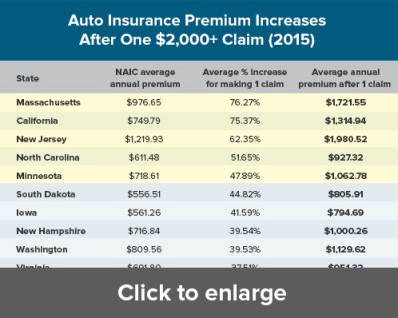

If you're involved in a mishap and have to make a claim, your premiums will certainly go up because your insurer thinks you're most likely to get in another mishap later on. Given that claim settlements can be pricey for insurance policy firms, they will increase your rates as a method to protect themselves versus future losses - auto insurance.

When you reinstate your insurance, you will deal with greater automobile insurance costs for not having continual coverage. If this takes place, you will have to find a brand-new supplier prior to you can drive lawfully again, Are car insurance costs much less expensive if you restore insurance coverage?

https://www.youtube.com/embed/DvidxwDllek

When you renew your insurance, you will face greater vehicle insurance coverage costs for not having continual coverage. It's feasible that your insurer might not permit you to restore your plan after it expires. If this occurs, you will have to locate a brand-new supplier prior to you can drive legally once again, Are car insurance coverage premiums less costly if you restore protection? The majority of insurer use vehicle drivers that restore their protection a discounted price.