The Only Guide to Older Drivers Stung By Higher Car Insurance Premiums - The ...

As an example, if you are a single 30-year-old lady who lives in Minnesota, a state that remains in the center when it involves the average price of insurance policy, you will likely discover your quote someplace in the $1136 each year range. If you are an 18-year-old man college pupil trying to obtain insurance coverage for the initial time, you will certainly find on your own paying a greater rate, even in the exact same state.

car insurance cheapest car affordable auto insurance cheap auto insurance

car insurance cheapest car affordable auto insurance cheap auto insurance

The make and also design of your lorry are very important factors to just how much average vehicle insurance coverage will be for you (cars). AAA's Your Driving Prices research study in 2018 located that the least pricey insurance coverage might be located for a small SUV, while one of the most pricey insurance coverage would be for a tiny sedan.

The insurance provider you pick to provide you with insurance coverage is also mosting likely to affect the cost - automobile. The prominent provider State Ranch has a few of the least expensive rates, while Liberty Mutual, an additional popular option, has some of the highest premiums. Automobile Insurance Policy Discounts, Luckily, there are a variety of discounts offered to assist you conserve cash on your cars and truck insurance.

perks cheapest car insurance auto cheap auto insurance

perks cheapest car insurance auto cheap auto insurance

Safe driver discount rate: This is offered to motorists that have a background of risk-free driving, implying they have not been associated with a crash or have actually taken a vehicle driver's education course. Safety and security and safety devices price cut: If you have actually mounted any type of anti-theft gadgets, such as an alarm system, you might receive this discount.

Your very own costs may vary. The quickest means to locate out exactly how a lot an auto insurance coverage policy would cost you is to use a quote calculator device.

The 6-Minute Rule for Average Cost Of Car Insurance: Everything You Need To Know

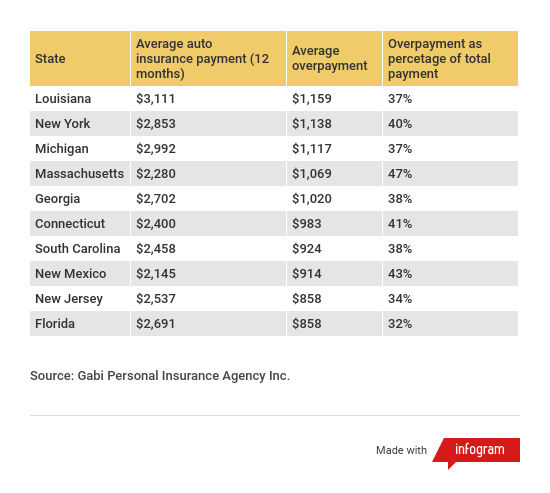

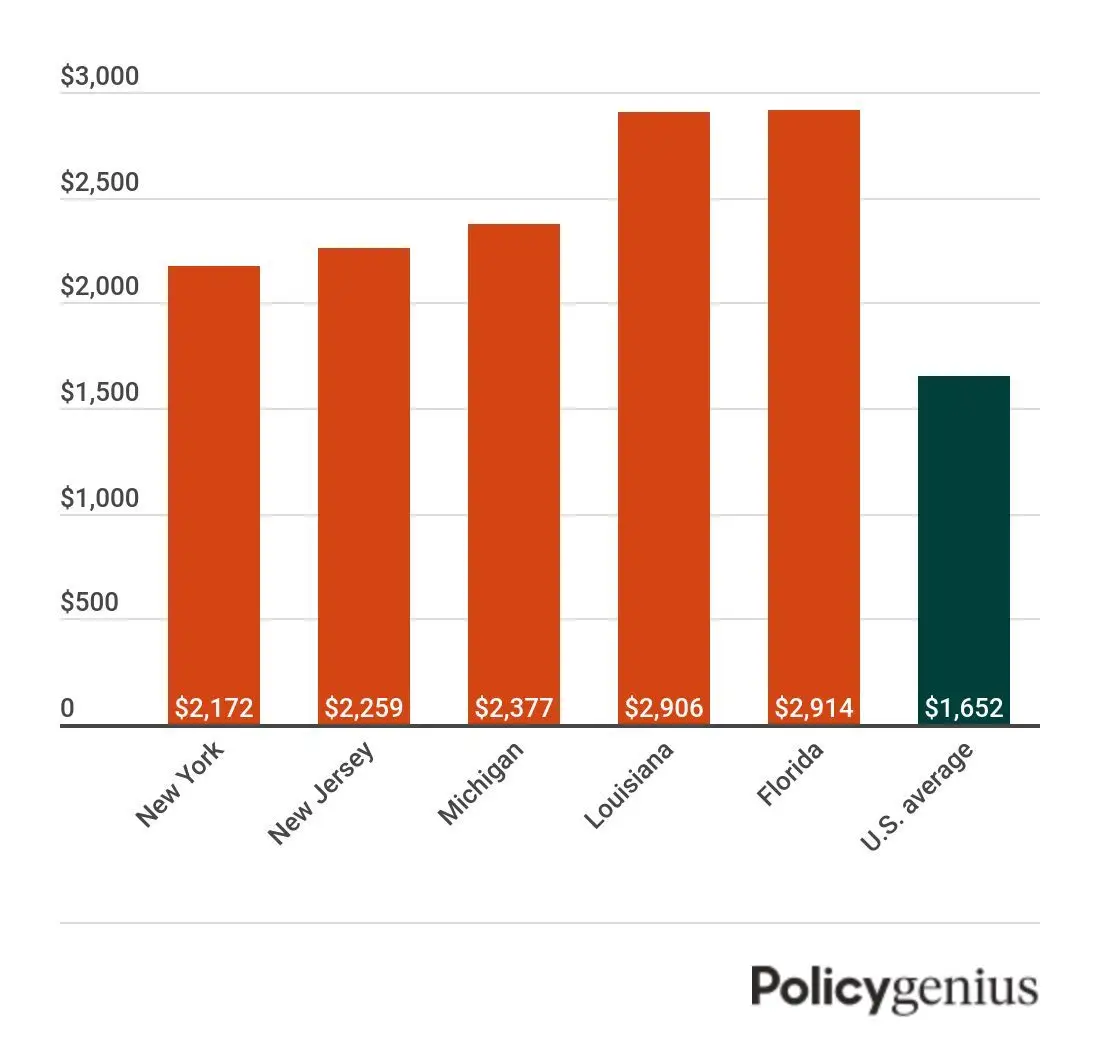

Various states additionally have various driving conditions, which can impact the cost of auto insurance coverage. To offer you some suggestion of what vehicle drivers in each state invest yearly on cars and truck insurance policy, the table listed below shows the typical cost of automobile insurance by state, according to the 2021 NAIC Car Insurance Policy Data Source Report - car insured.

Bundling: Packing your home as well as car insurance plan commonly results in premium discounts. You can additionally conserve cash for insuring several lorries under the very same policy. Paying upfront: Most insurance companies provide a pay-in-full discount rate. If you have the ability to pay your entire costs at the same time, it's often an extra cost-effective option.

Our methodology Due to the fact that customers rely on us to supply unbiased and also exact info, we created an extensive ranking system to develop our positions of the most effective automobile insurance coverage firms. credit. We gathered information on lots of auto insurance carriers to quality the firms on a large range of ranking factors. Completion result was an overall ranking for each and every supplier, with the insurance companies that racked up the most points topping the list.

Schedule: Automobile insurance coverage business with greater state accessibility as well as few eligibility demands racked up highest possible in this group. Coverage: Firms that offer a selection of selections for insurance policy protection are much more likely to satisfy customer needs. When it comes to variables that influence the average vehicle insurance coverage cost, there are some aspects that you can control, at least partly.

Some Ideas on New Jersey Drivers See Among Biggest Car Insurance ... You Should Know

Cars and truck insurance policy is usually at its highest when you are a teenage chauffeur, as well as the rates might proceed to be high until you are about 25. accident. Nevertheless, also within the 16-25 age range, you'll see these rates go down. At age 20, the ordinary vehicle driver can anticipate to pay concerning $3300 for full coverage.

In nearly every state, a minimum of some quantity of cars and truck insurance policy is called for by law to get behind the wheel. Being legally needed, vehicle insurance is important to keep you protected from the financial problem of a variety of poor points that can take place in, around, and to your cars and truck.

We'll damage down exactly how we value Lemonade Automobile plans, so you can obtain the facts as well as make an application for the insurance coverage you need with confidence. One of the most straightforward means to obtain a sense of how we value Lemonade auto insurance is by getting insurance coverage. insure. It's fast, easy, as well as simple to contrast.

Picking a greater deductible will normally lead to reduced premiums, considering that it indicates you would certainly be accountable for more of the first expenses in case of a mishap. What the price of Lemonade Vehicle covers If you desire to take a deep study every one of the coverage kinds used by Lemonade Car, we have actually got you covered below.

If you're interested in finding out more regarding a policy with Lemonade Automobile, Click here for more info the simplest method to explore your protection optionsand what you 'd payis by making an application for a quote. It's quickly, very easy, and also a little enjoyable.

The Facts About Cheap Car Insurance Of April 2022 – Forbes Advisor Revealed

If you have actually got vehicle insurance coverage or are shopping around for some you may have listened to the term "deductible." When you build a cars and truck insurance policy, you'll have to decide just how much of an insurance deductible you desire, usually either $500 or $1,000. So exactly what is an automobile insurance deductible? And also just how much should your own be? We'll help you recognize your insurance deductible as well as what's finest for your auto insurance policy to aid secure what matters most.

Insurance deductible So what's the difference in between your insurance coverage premium and your deductible? The premium is what you pay monthly, every 6 months or each year relying on your policy's payment strategy to keep your insurance coverage plan - vans. Your insurance coverage deductible is the quantity of cash you'll have to pay of pocket prior to your insurance policy coverage kicks in and also pays for your claim.

This is because you're basically paying to have less out-of-pocket expenses ought to you submit an insurance claim, so your future claims payments may cost the insurer greater than a person with a greater deductible. On the other hand, the higher your insurance deductible, the reduced your costs will be. Average Car Insurance Insurance Deductible The ordinary auto insurance coverage deductible is $500, which, if a claim is submitted, will typically be less than whatever the price of fixings are for a major crash.

With a $500 insurance deductible, you would just pay $500 in the direction of the repair services, while your insurance firm would certainly pay the rest. Depending on the possible cost of repairs for damages to your car as well as your budget plan, the dimension of your insurance deductible could be larger or smaller.

Insurance coverage service providers desire to see demonstrated responsible actions, which is why traffic mishaps and also citations are factors in figuring out cars and truck insurance coverage prices. Maintain in mind that points on your certificate don't remain there for life, however how long they remain on your driving document differs depending upon the state you stay in and also the severity of the infraction.

The Best Strategy To Use For Full Coverage Car Insurance Cost Of 2022

For instance, a brand-new sporting activities cars and truck will likely be much more expensive than, say, a five-year-old car. If you pick a reduced insurance deductible, it will cause a higher insurance expense which makes picking a higher deductible feel like a quite excellent bargain. money. A greater deductible might mean paying even more out of pocket in the occasion of a crash.

What is the average automobile insurance expense? There are a wide range of elements that affect just how much car insurance coverage expenses, which makes it difficult to get an accurate concept of what the ordinary individual spends for auto insurance coverage. According to the American Auto Association (AAA), the typical expense to guarantee a sedan in 2016 was $1222 a year, or around $102 per month. suvs.

Nationwide not only offers competitive prices, but likewise a variety of discount rates to help our members conserve even extra. Exactly how do I obtain cars and truck insurance? Obtaining a vehicle insurance price quote from Nationwide has actually never been less complicated. See our automobile insurance quote area as well as enter your zip code to begin the auto insurance coverage quote process.

affordable auto insurance vehicle insurance insurance low cost auto

affordable auto insurance vehicle insurance insurance low cost auto

Typically automobile insurance coverage business will bill extra for younger motorists and also provide reduced rates for older motorists. Insurance carriers see young motorists as unskilled and have a higher risk of entering crash. In Texas, the common teen motorist between the age of 16 and also 19 will pay $278. 89 each month while a vehicle driver in their 40s will certainly pay an average of $132 (car).

26 More usually than not, motorists that presently have cars and truck insurance protection will certainly receive a more affordable monthly price than chauffeurs that do not - affordable auto insurance. Because vehicle insurance is a requirement in all 50 states, business might wonder about why you don't presently have coverage.

9 Simple Techniques For Average Car Insurance Costs In Texas - Smartfinancial

Insurance coverage, Avg monthly price Complete Protection $138. We track and also record quotes that providers have provided based on different standards. The prices and standards revealed on this web page ought to only be used as an estimate. car.

Average Car Insurance Prices by Insurance Coverage Level When it comes to protecting your automobile, we recognize that everybody's needs are different. That's why we provide various kinds of car insurance policy protection. Having complete coverage aids you remain safe on the roadway. This is additionally one of the reasons the ordinary price of auto insurance coverage varies between customers.

cheaper cars cars vehicle insurance cars

cheaper cars cars vehicle insurance cars

A plan that will certainly pay for residential property problems up to $50,000 will have a greater costs than one that only pays for repair services up to $25,000. Ordinary Automobile Insurance Policy Rates by Age Your automobile insurance coverage rates will certainly additionally vary based upon your age team. cars and truck insurance firms usually think about young drivers, like teenagers, to be more of a risk behind the wheel.

Average Cars And Truck Insurance Policy Rates by State The typical car insurance price by state differs. According to the Insurance Info Institute (III), Iowa has some of the least expensive auto insurance coverage in the country at $674, while Louisiana had some of the most expensive at $1,443.

At What Age Is Vehicle Insurance Policy Cheapest? Generally, cars and truck insurance coverage premiums cost more for motorists that are more youthful than 25. 5 That implies as a motorist ages and gets even more experience when traveling, their rates will likely decrease. 6 For some individuals, these rates can start to enhance once again after the age of 65 when you're taken into consideration a senior resident.

Getting The Car Insurance Prices - State Farm® To Work

Which Age Team Pays the Most for Car Insurance coverage? Insurer usually charge more for drivers that are under the age of 25. 7 If you are 50 years or older, you meet the AARP member age demand and can get insurance coverage with The Hartford. insurers. Because 1984, The Hartford has assisted almost 40 million AARP members obtain the auto insurance coverage they require via unique benefits and discount rates What State Has the most affordable ordinary auto insurance prices? According to III, in 2017, these states had several of the most affordable car insurance coverage rates:8 To get more information, obtain a quote from us today.

https://www.youtube.com/embed/CCBXUuq_gA8

They'll help you obtain the car plans you need, whether it's to help pay for damages after an accident or to protect you from crashes with uninsured drivers. low cost.