Little Known Questions About Dmv - Idaho Transportation Department.

You might have the ability to discover even more information about this as well as similar material at. cheaper car.

Average Automobile Insurance Coverage Prices by Protection Level When it comes to safeguarding your cars and truck, we understand that everyone's needs are various. That's why we use numerous sorts of car insurance coverage. Having full coverage helps you stay safe on the roadway. This is also one of the reasons why the typical cost of vehicle insurance policy ranges clients.

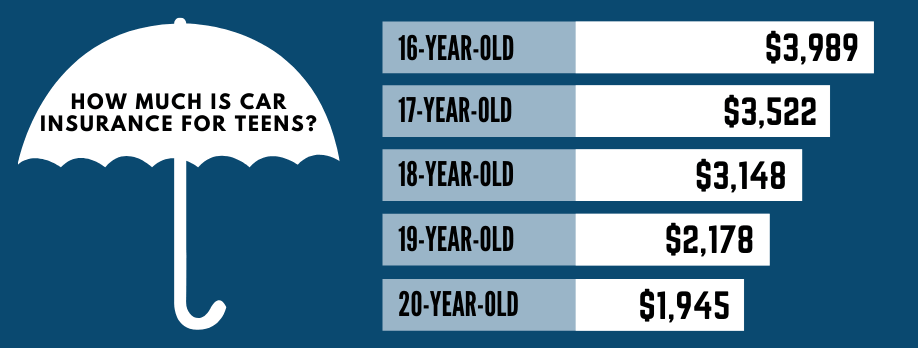

As an example, a policy that will certainly spend for home damages approximately $50,000 will certainly have a higher costs than one that just pays for fixings as much as $25,000. Average Automobile Insurance Coverage Prices by Age Your car insurance coverage prices will certainly additionally differ based upon your age group. automobile insurance policy business commonly take into consideration young chauffeurs, like teens, to be even more of a danger behind the wheel.

On top of this, automobile insurance is normally much more costly for males than females. 3 The longer you've been driving and also the older you obtain, the less expensive automobile insurance prices tend to be. Typical Car Insurance Prices by State The ordinary car insurance coverage price by state varies. According to the Insurance Info Institute (III), Iowa has some of the cheapest car insurance in the nation at $674, while Louisiana had some of one of the most costly at $1,443.

At What Age Is Cars And Truck Insurance Policy Cheapest? 6 For some people, these prices can start to enhance again after the age of 65 when you're thought about a senior resident.

Average Car Insurance Cost (May 2022) - Wallethub - Truths

Which Age Group Pays the Many for Car Insurance? Because 1984, The Hartford has aided virtually 40 million AARP members get the vehicle coverage they need via unique advantages as well as discount rates What State Has the Most affordable average vehicle insurance prices? According to III, in 2017, these states had some of the least expensive automobile insurance prices:8 To discover much more, get a quote from us today.

liability low cost automobile auto insurance

liability low cost automobile auto insurance

They'll aid you get the vehicle plans you require, whether it's to aid spend for damages after a mishap or to secure you from accidents with without insurance drivers.

You will relocate: Where you live is a vital aspect in identifying your rates. cheaper. Your credit scores have transformed significantly: Vehicle insurer with the exemption of those in The golden state, Hawaii, Maryland as well as Massachusetts consider your credit rating when setting your price. Your motoring history has enhanced: If it's been some time considering that your last accident or driving offense, your rate might enhance.

Your driving routine has actually changed: If you're driving fewer miles these days or no longer travelling for job, you might desire to look around to see if you can obtain a lower rate - insurers.

Having the right details in hand can make it easier to obtain a precise vehicle insurance quote. You'll wish to have: Your vehicle driver's permit number Your automobile identification number (VIN) The physical address where your car will be saved You may likewise desire to do a little research study on the kinds of coverages offered to you - vehicle.

My New Car Is 3 Times More Expensive Than My Old One ... Can Be Fun For Everyone

Packing Something is filling. If you're in the market for your next plan, anticipate to pay $1,070 per year, according to current information from the Insurance Coverage Info Institute. It's necessary to recognize all the aspects that can affect your protection rate considering that not everyone's price is the same.Car insurance policy policies have great deals of moving components, as well as your premium, or the price you'll pay for insurance coverage, is simply one of them.

Insurance provider consider several different variables, consisting of the state and location where you live as well as your gender, age, driving background, and the degree of coverage you would love to have. Expert put together information from industry regulatory authorities, individual financing magazines, and also contrast websites to establish which elements influenced auto insurance expenses and also what the normal vehicle driver can expect to pay.

There have actually been several major adjustments to automobile insurance policy costs throughout the coronavirus pandemic. Some cars and truck insurance providers offer discounts as Americans drive much less and also are aiding people influenced by the virus delay repayments. Average car insurance coverage price by state, Every state takes care of car insurance coverage differently. States control their regulations and also plans about cars and truck insurance policy coverage, including exactly how much coverage is required, just how much insurance is accountable for covering, and what variables insurer can make use of to figure out prices.

The variety of years you've been driving will certainly additionally impact the rate you'll pay for insurance coverage. Vehicle insurance coverage expenses have a tendency to fall with age. However, that makes insuring a teen chauffeur incredibly pricey. It's additionally vital to bear in mind that it will certainly vary from individual to individual, no matter of your age based on various other elements like your driving history.

When you're wed, car insurance coverage sets you back extra. After an accident, premiums jump 30%, according to and Insure. com reporting, based on data from Quadrant Information Solutions. With a DUI on your document, insurance coverage will set you back 63% more, according to Insurance policy. com and also Guarantee. com coverage. Consumer Records compiled rate valuing information from automobile insurance policy business in every state, and also discovered that credit report were one of the biggest consider premium expenses.

Getting The Car Insurance: Auto Insurance Coverage For May 2022 To Work

Three states (The golden state, Hawaii, and also Massachussetts) don't allow credit rating ratings to be factored into cars and truck insurance coverage costs. Automobile insurance is more affordable in zip codes that are a lot more rural, and also the same is real at the state level.

Car insurance coverage has whole lots of elements that go into its prices (insurance). Information from the National Organization of Insurance coverage Commissioners reveals just how much vehicle insurance coverage costs have actually raised over time.

Each insurance policy business checks out every one of these aspects and also rates your protection in different ways consequently. It's vital to contrast what you're provided. Get quotes from a number of different automobile insurance provider as well as compare them to see to it you're getting the most effective bargain for you. Individual Money Press Reporter Personal Finance Reviews Other.

Vehicle insurance coverage is required to shield you monetarily when behind the wheel.!? Right here are 15 techniques for conserving on automobile insurance coverage costs.

Lower automobile insurance coverage prices might additionally be readily available if you have various other insurance policies with the very same business. Automobile insurance policy costs are various for every motorist, depending on the state they live in, their option of insurance company as well as the kind of protection they have.

Not known Details About What To Do If You Can't Afford Car Insurance - Roanoke Times

The numbers are relatively close together, suggesting that as you budget for a new cars and truck purchase you may need to include $100 approximately each month for car insurance coverage. car insurance. Keep in mind While some things that influence automobile insurance coverage rates-- such as your driving background-- are within your control others, costs might likewise be affected by things like state guidelines and also state crash prices.

Once you understand just how much is cars and truck insurance coverage for you, you can place some or every one of these techniques t job. 1. Make The Most Of Multi-Car Discounts If you obtain a quote from a vehicle insurer to insure a single lorry, you might finish up with a higher quote per car than if you asked about insuring a number of motorists or automobiles with that business. risks.

If your youngster's grades are a B average or over or if they rank in the top 20% of the course, you may be able to obtain a good trainee price cut on the protection, which generally lasts until your youngster turns 25. These discount rates can range from as low as 1% to as much as 39%, so be certain to show evidence to your insurance policy representative that your teen is a good student - trucks.

Allstate, as an example, provides a 10% car insurance discount and a 25% home owners insurance price cut when you bundle them with each other, so check to see if such discounts are available and also relevant. 2. Pay Interest when traveling Simply put, be a risk-free motorist. This should go without stating, however in today's age of raising in-car disturbances, this births mentioning as a lot as feasible.

cheaper car insurance credit car low cost

cheaper car insurance credit car low cost

:max_bytes(150000):strip_icc()/how-much-does-car-insurance-cost-5072100_final-915c31d331c9435085f258da3e1e1852.png) low cost cheap car cheap prices

low cost cheap car cheap prices

trucks insurance affordable cheapest car business insurance

trucks insurance affordable cheapest car business insurance

Travelers supplies secure chauffeur discounts of in between 10% and also 23%, depending on your driving record. For those not aware, factors are generally evaluated to a chauffeur for moving offenses, and extra factors can lead to greater insurance premiums (all else being equivalent).

The 45-Second Trick For What To Do If You Can't Afford Car Insurance - Autos - Times ...

money cheapest auto insurance car insurance car

money cheapest auto insurance car insurance car

Insurance policy companies wish to see demonstrated liable actions, which is why website traffic mishaps and citations are consider figuring out automobile insurance prices. Aims on your permit do not remain there permanently, yet how long they remain on your driving record differs depending on the state you live in and also the severity of the infraction.

As an example, a brand-new sports auto will likely be extra costly than, claim, a five-year-old sedan. If you pick a reduced deductible, it will certainly lead to a higher insurance policy costs which makes picking a greater insurance deductible feel like a respectable deal. A higher insurance deductible might suggest paying more out of pocket in the event of a mishap.

What is the typical automobile insurance coverage price? There are a variety of variables that affect how much auto insurance coverage costs, which makes it hard to get an exact idea of what the typical individual pays for cars and truck insurance coverage. According to the American Car Organization (AAA), the typical expense to insure a car in 2016 was $1222 a year, or around $102 monthly.

Nationwide not just offers competitive rates, yet likewise a variety of discounts to help our participants conserve a lot more. So, how do I get auto insurance coverage? Obtaining a car insurance price quote from Nationwide has actually never ever been simpler. See our automobile insurance coverage quote section as well as enter your postal code to begin the auto insurance policy quote process.

If you have a history of having vehicle insurance policy policies without submitting cases, you'll obtain cheaper rates than somebody who has actually submitted claims in the past.: Vehicles that are driven less frequently are much less most likely to be involved in a crash or various other harmful occasion. Cars with reduced annual mileage might get approved for slightly lower prices.

The Single Strategy To Use For How Much Is Car Insurance? These Are The Average Costs

To find the most effective car insurance for you, you ought to comparison shop online or speak with an insurance agent or broker. You can, however make certain to keep track of the protections selected by you and offered by insurance providers to make a fair contrast. You can who can aid you locate the finest combination of price and fit.

Independent agents benefit numerous insurance provider and can compare amongst them, while restricted representatives help only one insurance provider. Offered the different ranking methodologies and variables used by insurance providers, no solitary insurance policy business will be best for everyone - insurance. To much better recognize your typical cars and truck insurance price, invest a long time comparing quotes across business with your chosen technique.

Your very own prices might vary. The quickest way to discover out exactly how a lot a vehicle insurance coverage policy would certainly cost you is to use a quote calculator device.

Different states additionally have various driving problems, which can impact the price of cars and truck insurance - insurers. To provide you some suggestion of what drivers in each state spend each year on auto insurance policy, the table below programs the average price of auto insurance by state, according to the 2021 NAIC Automobile Insurance Policy Data Source Report.

Bundling: Bundling your residence as well as car insurance coverage policies commonly results in premium discount rates. Paying ahead of time: A lot of insurance companies supply a pay-in-full discount rate.

Compare Car Insurance Quotes & Rates 2022 - Way.com Can Be Fun For Everyone

Our method Due to the fact that customers rely upon us to provide objective as well as precise details, we produced a thorough ranking system to create our positions of the very best auto insurer. We gathered information on lots of vehicle insurance service providers Informative post to grade the firms on a wide variety of ranking elements. The end result was a total score for every service provider, with the insurance providers that scored one of the most factors topping the list.

https://www.youtube.com/embed/oJTZ0YBXHJA

Availability: Car insurance provider with greater state availability and few qualification needs scored highest possible in this group. Coverage: Companies that use a range of options for insurance policy protection are extra most likely to satisfy consumer demands. Expense: Average vehicle insurance policy rates and also discount chances were both taken into account. insurers. Customer Experience: This rating is based on volume of grievances reported by the NAIC and also customer satisfaction ratings reported by J.D.