Thinking About Buying A Car? Here's What Experts Say You ... Things To Know Before You Buy

prices car car insurance cheap auto insurance

prices car car insurance cheap auto insurance

Despite the fact that you may not have experience on the roadway, if you're over 25, you may see reduced prices than a teen motorist. car. One more point to take into consideration is that if you reside in an area that has public transportation or you do not intend on driving much, there are alternatives to standard insurance coverage, like usage-based insurance policy.

Immigrants and also foreign nationals can be classified as new motorists when they first go into the united state. cheap. This is due to the fact that automobile insurer normally examine residential driving records, so you can have a tidy driving record in one more nation as well as still be thought about an inexperienced driver after relocating to the States.

Our referrals for automobile insurance for new drivers Whether you're a new vehicle driver or have been driving for decades, researching as well as comparing quotes from a number of service providers is a terrific method to discover the best price. Our insurance coverage professionals have discovered that Geico and also State Farm are excellent options for auto insurance policy for new vehicle drivers.

Below are the elements our rankings take into consideration: Cost (30% of complete score): Auto insurance coverage price price quotes created by Quadrant Information Services as well as discount possibilities were both taken right into consideration. Insurance coverage (30% of total score): Companies that supply a range of selections for insurance protection are more probable to satisfy customer demands. low-cost auto insurance.

That indicates figuring out exactly how much it will certainly cost to include your child to your automobile insurance policy. Whether this is your very first youngster or your 3rd, adding a teenager driver to your cars and truck insurance coverage plan can be pricey.

A Biased View of Best Car Insurance For Teens, Students, And New Drivers

How Much Does it Cost to Guarantee a Teenager Driver? Typically, when a vehicle driver stores around for auto insurance, details factors such as driving document, marriage standing, as well as credit rating play a large component in determining exactly how much those rates will certainly be. A teen motorist doesn't usually have much experience in any of these groups, so you should consider other things.

If your teenager is going to drive a newer auto, expect to pay a whole lot much more for vehicle insurance coverage than you would certainly on a cheaper, used design - cheap insurance. Do I Have to Add My Teenager Motorist to My Automobile Insurance?

"You're not needed to add a teen chauffeur to your vehicle insurance, however it's more cost-effective to do so," states Melanie Musson, an auto insurance specialist for "From the very first time a pupil vehicle driver obtains behind the wheel, moms and dads must understand if the child is covered under their strategy or if they require to be added," claims Musson.

low cost auto credit cars cheaper car insurance

low cost auto credit cars cheaper car insurance

If your teen's auto is in their name, they will be unable to be listed on your policy, as well as they'll have to obtain their very own. Nonetheless, if a teen falls under a parent's plan, they can remain on that plan as long as they reside in the home as well as drive among the family cars and car insured trucks. vans.

insurance risks auto insurance risks

insurance risks auto insurance risks

Similar to any type of driver, it is constantly best to have the minimal state needed insurance - vehicle. Driving without any type of insurance coverage is against the legislation and also can include some significant legal and economic ramifications. cheap. Insure Under Your Policy, It could make feeling financially to include your teenager to your insurance coverage policy.

Getting My Average Car Insurance Rates By Age And State (May 2022) To Work

, including a 16-year-old women vehicle driver adds $1,593 a year to a parent's complete protection plan on average. It's about $651 a year to include minimal coverage for the exact same teen. The typical bill for including a 16-year-old man costs $1,934 a year on a parent's full coverage policy, and also includes about $769 for minimum coverage.

Still, including a teen to a moms and dad's policy is dramatically more affordable than having the teenager get their own policy. Below you can compare typical annual rates for 16-year-olds, 17-year-olds, and also 18-year-olds with their own policy (business insurance).

One more often-overlooked means to save money on auto insurance coverage for everybody, and not just teen chauffeurs, is to go to a safe driving program. There are local driving schools that provide defensive driving courses, or chauffeurs can call the National Safety and security Council or AAA to find schools in their state.

Exactly how much is automobile insurance coverage for teenagers? When it comes to car insurance policy for teenagers, young motorists pay more than their older, much more skilled counterparts-- concerning $169 per month on average, according to our evaluation.

The 7-Minute Rule for Best Car Insurance For Teens, Students, And New Drivers

And also, insurer don't have as much information to consider when examining just how liable a teen vehicle driver gets on the road. That indicates even more danger to insurance firms, which is why cars and truck insurance policy for teens is more pricey (cheaper auto insurance). Teen male vs. women auto insurance coverage prices, In our evaluation, we discovered that male teenager drivers pay about $20 even more per month than women teen chauffeurs.

insured car insurance company cheaper car insurance auto insurance

insured car insurance company cheaper car insurance auto insurance

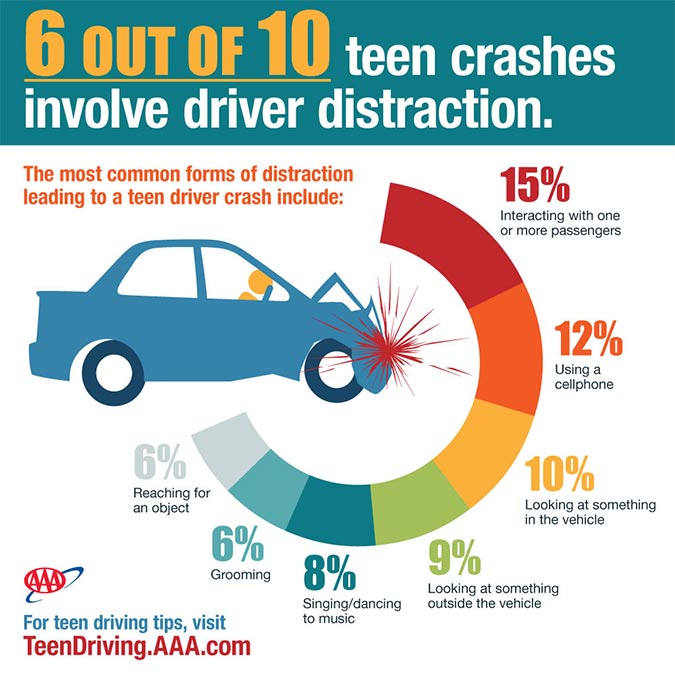

Teen males are more most likely to enter wreckages. car. They've created two-thirds of all crashes among teens 16 to 19 in recent years, according to IIHS data. Just how to locate low-cost insurance policy for teens, The best way to discover low-cost auto insurance coverage for teens is to contrast rates from a number of business.

While they all consider teenager motorists riskier to insure than older motorists, they do not all upcharge teens the exact same amount. The only means to see which supplies a young vehicle driver the best price is to contrast quotes side by side (cheapest). Along with looking around, search for teen-specific car insurance policy discounts, like the ones pointed out below.

https://www.youtube.com/embed/zM_MYytdNpg

An additional means to make automobile insurance coverage for teenagers much more budget friendly is to minimize their insurance coverage levels. However this is high-risk as well as might not also be feasible. For instance, a loan provider might not permit clients to get rid of accident and also thorough insurance coverage if they have a lease or lending on their lorry.