The 7-Second Trick For Full Coverage Car Insurance - Safeauto

What's Not Covered? When you inform your insurance coverage agent you desire full coverage, it's easy to assume you have every insurance policy protection readily available. However lots of automobile insurance choices are not constantly included in policies. If you intend to be totally covered, consider including these: Uninsured and also Underinsured Motorist Insurance: This protection pays for your cars and truck fixings when the individual that triggered the accident can not pay.

insurance companies cheapest insured car car insurance

insurance companies cheapest insured car car insurance

cars vans automobile cheaper car

cars vans automobile cheaper car

When Complete Protection Does Not Completely Cover You Visualize you triggered an accident, and the auto you hit was a deluxe sedan - car. 2 of the passengers were carried to the health center with lethal injuries. After the crash, you may discover that you have the best sort of insurance coverage, simply not nearly enough of it. cheaper auto insurance.

The extensive as well as collision elements safeguard the insurance policy holder and also their vehicle in the event of a mishap. Full insurance coverage auto insurance policy is usually extra pricey than various other kinds of insurance policy due to the fact that it provides more protection.

What Does Complete Insurance Coverage Insurance Coverage Normally Cover? There are numerous scenarios that full protection car insurance coverage covers - auto.

For example, if you only have physical liability as well as residential or commercial property damages obligation, then your policy is liability-only insurance policy. If you have physical obligation, residential or commercial property damage obligation, comprehensive, crash and also various other protection, then you have complete protection. prices. If you have an online account or your insurance coverage carrier has a mobile application, you might also see the details of your plan there.

cheaper read more credit score cheap car perks

cheaper read more credit score cheap car perks

Understanding Complete Protection Car Insurance Policy, While full protection automobile insurance coverage provides monetary security, it may not appropriate for everybody. There are instances when it is not the very best option. Know the pros and cons and find out if full protection auto insurance policy is a great option for you. The Benefits and Drawbacks of Complete Protection, Comprehending the benefits and drawbacks of full auto insurance coverage is necessary to aid you determine whether it is the right choice.

How What Is Full Coverage Auto Insurance? - Credit Karma can Save You Time, Stress, and Money.

That Will Need Full Coverage? While a lot of states, if not all, call for chauffeurs to have car insurance coverage, having full auto protection is not mandated by legislation (business insurance).

You also get protection versus criminal damage and also theft. Should You Take Into Consideration Getting Complete Insurance Coverage? Examining your needs and circumstances will certainly be the primary step to figure out whether you should think about getting complete coverage car insurance. If you fall under any one of the circumstances discussed above, then paying added for full insurance coverage makes good sense. auto.

As an example, if you are driving an old or low-value vehicle, paying extra on automobile insurance may not be the finest suggestion. If you can afford the price of substitute or fixing of your automobile if it gets harmed or swiped, after that you may choose a state minimum protection. car insurance.

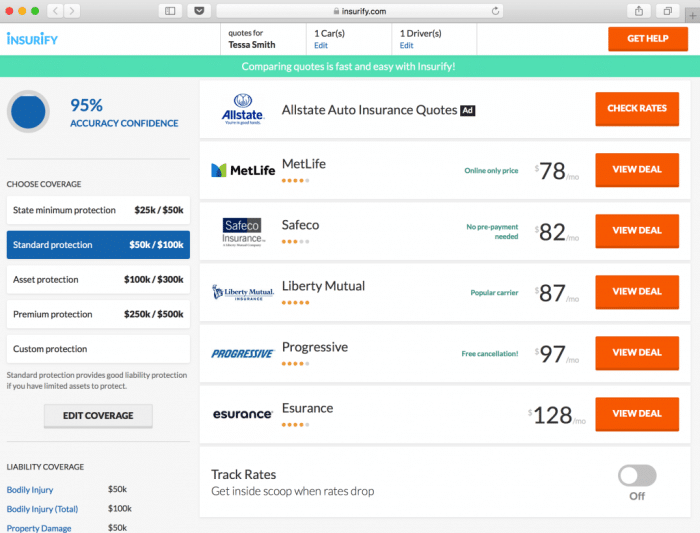

Just How to Obtain Complete Coverage Car Insurance policy, A lot of significant insurance service providers supply detailed and crash insurance policy - trucks. You might also find business that have optional protections.

That suggests a complete coverage plan usually costs $526 or 58. insured car. 4 Ways to Save On Complete Insurance Coverage Car Insurance coverage, Some people decrease complete protection automobile insurance coverage due to the high premium costs.

Complete insurance coverage automobile insurance coverage also has these insurance coverages (cheaper cars). It generally consists of comprehensive and accident protection that will certainly cover damage expenses to your lorry.

Everything about What Is Full Coverage Auto Insurance? - Metromile

Typically, the expense to repair or replace a new auto is high, so having full protection makes good sense. The older and also much more made use of a vehicle is, the reduced its value is (low cost auto). If you assume that paying for extensive as well as collision coverage is a lot more pricey than the expense of repair service and replacement of your vehicle, after that it might be finest not to obtain full insurance coverage - car.

Cash, Nerd breaks down some related terms and concepts that may aid you.Car Insurance: Search for the very best automobile insurance policy near you by clicking on the state where you live. Cash, Nerd additionally addresses a few of the most usual inquiries people ask about auto insurance.Car Insurance Calculator: Money, Nerd aids you get an estimate on just how much your auto insurance will set you back based on your state, age, gender, credit scores score, car kind and also year, driving record as well as coverage.GAP Insurance: Figure out what space insuranceis, what it covers as well as how it functions. credit. Find a checklist of the very best insurance provider offering

https://www.youtube.com/embed/q5wbp3oEq10

without insurance driver coverage.Uninsured Vehicle driver Statistics 2021: Find a break down of one of the most vital facts regarding without insurance vehicle drivers. Learn which states have the most uninsured motorists and also just how you can safeguard on your own on the road.Best Inexpensive Auto Insurance policy as well as Ordinary Expenses for 18-Year-Olds: Age can additionally influence the cost of automobile insurance policy. Cash, Geek assesses theprice of car insurance coverage for elders to assist you locate the most affordable alternative. Concerning the Author. A complete insurance coverage plan depending upon state legislations might also cover uninsured vehicle driver coverage as well as a clinical insurance coverage of injury defense or medical settlements.